GEV Stock Price: Insights and Analysis

Introduction

Investing in the stock market can be a complex endeavor, especially when it comes to understanding the dynamics of specific stocks like GEV. The GEV stock price has been a topic of interest for many investors, analysts, and financial enthusiasts. This comprehensive guide aims to provide detailed insights into GEV stock price, covering its historical trends, factors influencing its movements, and future projections. By the end of this article, you will have a clearer understanding of GEV stock price and how to make informed investment decisions.

Historical Performance of GEV Stock Price

To understand the current and future potential of GEV stock price, it’s crucial to examine its historical performance. Over the past decade, GEV stock price has experienced significant fluctuations, driven by various market forces and company-specific events. By analyzing historical data, investors can identify patterns and trends that may help predict future movements of GEV stock price.

Key Factors Influencing GEV Stock Price

Several factors influence GEV stock price, including macroeconomic conditions, industry trends, and company performance. Economic indicators such as GDP growth, interest rates, and inflation can have a substantial impact on GEV stock price. Additionally, industry-specific developments, such as technological advancements and regulatory changes, play a critical role in shaping the GEV stock price.

The Impact of Market Sentiment on GEV Stock Price

Market sentiment, which reflects the overall attitude of investors towards a particular stock, is another significant factor affecting GEV stock price. Positive news, such as strong earnings reports or strategic partnerships, can boost investor confidence and drive up GEV stock price. Conversely, negative news, such as management changes or legal issues, can lead to a decline in GEV stock price.

Analyzing GEV Stock Price with Technical Indicators

Technical analysis involves using various indicators and chart patterns to predict future movements of GEV stock price. Common technical indicators include moving averages, relative strength index (RSI), and Bollinger Bands. By understanding these indicators, investors can make more informed decisions about when to buy or sell GEV stock, maximizing their returns.

The Role of Fundamental Analysis in Evaluating GEV Stock Price

Fundamental analysis focuses on evaluating a company’s financial health and performance to determine the intrinsic value of its stock. Key metrics such as earnings per share (EPS), price-to-earnings (P/E) ratio, and revenue growth are essential in assessing GEV stock price. A thorough fundamental analysis helps investors understand whether GEV stock is undervalued or overvalued, guiding their investment decisions.

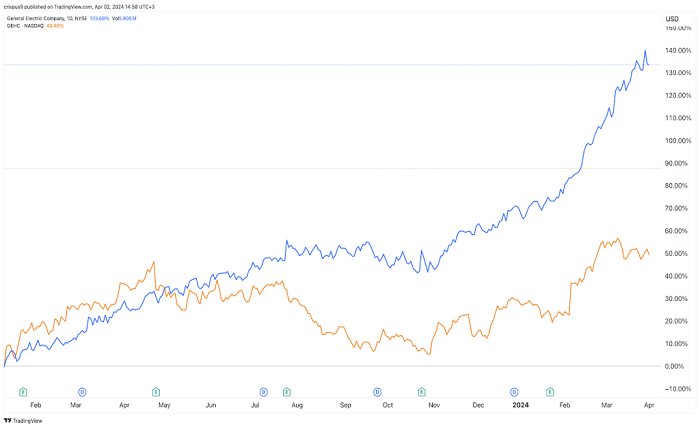

Comparing GEV Stock Price with Industry Peers

Benchmarking GEV stock price against its industry peers provides valuable insights into its relative performance. By comparing financial metrics, growth rates, and market capitalization, investors can determine how GEV stock price stacks up against competitors. This comparison helps identify potential investment opportunities and assess the competitive position of GEV in the market.

Recent Developments and Their Impact on GEV Stock Price

Staying updated with recent developments is crucial for understanding the current trajectory of GEV stock price. Significant events such as mergers and acquisitions, product launches, or changes in leadership can have immediate effects on GEV stock price. Keeping an eye on news and announcements helps investors anticipate potential movements and adjust their strategies accordingly.

Future Projections for GEV Stock Price

Predicting the future trajectory of GEV stock price involves analyzing various factors, including market trends, company performance, and economic forecasts. While no prediction is foolproof, using a combination of technical and fundamental analysis can provide a reasonable outlook on GEV stock price. Investors should stay informed and be prepared to adapt to changing market conditions.

Strategies for Investing in GEV Stock

Developing a strategic approach to investing in GEV stock can enhance your chances of success. Diversifying your portfolio, setting realistic investment goals, and staying disciplined are essential components of a successful investment strategy. Understanding the factors influencing GEV stock price and conducting thorough research will help you make informed decisions and manage risks effectively.

Common Mistakes to Avoid When Investing in GEV Stock

Investing in stocks, including GEV, comes with its set of challenges and risks. Common mistakes such as emotional decision-making, lack of research, and failure to diversify can negatively impact your investment outcomes. By being aware of these pitfalls and adopting a disciplined approach, you can navigate the complexities of GEV stock price and improve your investment performance.

Conclusion

The GEV stock price is influenced by a myriad of factors, ranging from macroeconomic conditions to company-specific developments. Understanding these factors and staying informed about recent developments are crucial for making informed investment decisions. By leveraging both technical and fundamental analysis, investors can gain valuable insights into GEV stock price and develop effective investment strategies. Whether you are a seasoned investor or a beginner, this comprehensive guide provides the knowledge and tools needed to navigate the dynamic world of GEV stock price.

FAQs

1. What are the primary factors influencing GEV stock price?

The primary factors influencing GEV stock price include macroeconomic conditions, industry trends, company performance, and market sentiment. Economic indicators such as GDP growth, interest rates, and inflation, along with company-specific developments and investor sentiment, play crucial roles in shaping GEV stock price.

2. How can technical analysis help in predicting GEV stock price movements?

Technical analysis involves using indicators and chart patterns to predict future movements of GEV stock price. Indicators like moving averages, RSI, and Bollinger Bands help investors identify trends and potential reversal points, aiding in making informed buy or sell decisions.

3. Why is fundamental analysis important for evaluating GEV stock price?

Fundamental analysis evaluates a company’s financial health and performance, helping determine the intrinsic value of its stock. Metrics such as EPS, P/E ratio, and revenue growth are essential in assessing whether GEV stock is undervalued or overvalued, guiding investment decisions.

4. How can comparing GEV stock price with industry peers be beneficial?

Benchmarking GEV stock price against industry peers provides insights into its relative performance. Comparing financial metrics, growth rates, and market capitalization helps investors assess the competitive position of GEV and identify potential investment opportunities.

5. What strategies can be effective for investing in GEV stock?

Effective strategies for investing in GEV stock include diversifying your portfolio, setting realistic investment goals, conducting thorough research, and staying disciplined. Understanding the factors influencing GEV stock price and staying informed about recent developments are crucial for making informed investment decisions.