Comprehensive Analysis of RYCEY Stock: Performance, Potential, and Investment Insights

Introduction

RYCEY stock represents Rolls-Royce Holdings plc, a leading manufacturer of power systems for aviation and other industries. Understanding RYCEY stock involves looking into its historical performance, current market position, and potential for future growth. This comprehensive analysis will help investors make informed decisions about RYCEY stock.

History of Rolls-Royce Holdings

To fully understand RYCEY stock, one must appreciate the history of Rolls-Royce Holdings. Founded in 1906, Rolls-Royce has grown into a global powerhouse in manufacturing and technology. The historical context of RYCEY stock provides insight into its longstanding reputation and stability in the market.

Current Market Position of RYCEY Stock

RYCEY stock is currently positioned as a significant player in the aviation and power systems sectors. This section analyzes the current market position of RYCEY stock, including its market capitalization, industry ranking, and recent performance metrics. Understanding the current standing of RYCEY stock is crucial for potential investors.

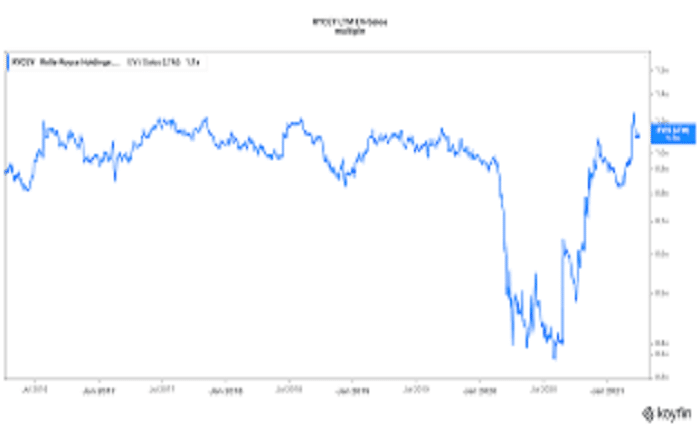

Recent Performance of RYCEY Stock

The recent performance of RYCEY stock reflects its resilience and adaptability in a volatile market. This section provides a detailed review of RYCEY stock’s recent performance, including quarterly earnings reports, stock price trends, and major business developments. Monitoring the recent performance of RYCEY stock helps investors gauge its short-term viability.

Factors Influencing RYCEY Stock

Several factors influence the performance of RYCEY stock, from economic conditions to industry-specific trends. This section explores the key factors that impact RYCEY stock, such as global economic health, technological advancements, and regulatory changes. Understanding these factors is essential for predicting future movements of RYCEY stock.

Analyzing Financial Statements of RYCEY

A thorough analysis of RYCEY stock requires examining Rolls-Royce Holdings’ financial statements. This section delves into the company’s income statements, balance sheets, and cash flow statements, providing a comprehensive financial overview. Analyzing financial statements helps investors assess the financial health and stability of RYCEY stock.

RYCEY Stock Dividend Analysis

Dividends are a crucial aspect of stock investment, and RYCEY stock is no exception. This section examines the dividend history of RYCEY stock, including dividend yield, payout ratio, and growth trends. Understanding the dividend potential of RYCEY stock can influence investment decisions, especially for income-focused investors.

Potential Growth Opportunities for RYCEY Stock

The potential growth opportunities for RYCEY stock are driven by innovation and market expansion. This section explores future growth opportunities, such as advancements in sustainable aviation technologies and expanding into new markets. Identifying growth opportunities is key to evaluating the long-term potential of RYCEY stock.

Risks Associated with Investing in RYCEY Stock

Investing in RYCEY stock, like any investment, comes with risks. This section outlines the major risks associated with RYCEY stock, including market volatility, competitive pressures, and geopolitical uncertainties. Understanding these risks is vital for making informed investment decisions regarding RYCEY stock.

Comparing RYCEY Stock with Competitors

Comparing RYCEY stock with its competitors provides a clearer picture of its market position and performance. This section compares RYCEY stock with other major players in the aviation and power systems industries, analyzing key metrics and competitive advantages. Comparative analysis helps investors determine the relative value of RYCEY stock.

Investment Strategies for RYCEY Stock

Effective investment strategies are crucial for maximizing returns on RYCEY stock. This section discusses various investment strategies for RYCEY stock, such as long-term holding, dividend reinvestment, and diversified portfolio approaches. Implementing the right strategy can enhance the potential benefits of investing in RYCEY stock.

Future Outlook for RYCEY Stock

The future outlook for RYCEY stock is shaped by technological advancements and market dynamics. This section provides a forward-looking analysis of RYCEY stock, considering industry forecasts, company initiatives, and potential challenges. Assessing the future outlook helps investors anticipate the long-term performance of RYCEY stock.

Conclusion

RYCEY stock represents a significant investment opportunity in the aviation and power systems sectors. By understanding its history, analyzing financials, evaluating growth opportunities, and considering associated risks, investors can make informed decisions about RYCEY stock. This comprehensive guide equips investors with the knowledge needed to navigate the complexities of RYCEY stock and potentially capitalize on its market presence.

FAQs

1. What is RYCEY stock? RYCEY stock represents Rolls-Royce Holdings plc, a global leader in manufacturing power systems for aviation and other industries.

2. How has RYCEY stock performed recently? RYCEY stock has shown resilience in a volatile market, with recent performance reflecting its adaptability and strong business fundamentals.

3. What factors influence RYCEY stock? Several factors, including global economic conditions, technological advancements, and regulatory changes, influence the performance of RYCEY stock.

4. Are there risks associated with investing in RYCEY stock? Yes, investing in RYCEY stock comes with risks such as market volatility, competitive pressures, and geopolitical uncertainties.

5. What are the future growth opportunities for RYCEY stock? Future growth opportunities for RYCEY stock include advancements in sustainable aviation technologies and expansion into new markets.