Comprehensive Guide to NVDL Stock: What Investors Need to Know

Introduction

Investing in the stock market can be both exciting and daunting, particularly when dealing with high-potential yet volatile stocks like NVDL stock. Understanding the intricacies of NVDL stock can help you make more informed investment decisions. This guide delves into various aspects of NVDL stock, offering insights into its performance, potential, and key factors to consider.

Overview of NVDL Stock

NVDL stock represents shares of NVIDIA Corporation, a global leader in graphics processing units (GPUs) and artificial intelligence (AI) technology. Known for its cutting-edge innovations, NVIDIA has seen its stock, symbolized as NVDL, gain significant attention in the market. Investors are drawn to NVDL stock due to the company’s consistent performance and promising future prospects.

Historical Performance of NVDL Stock

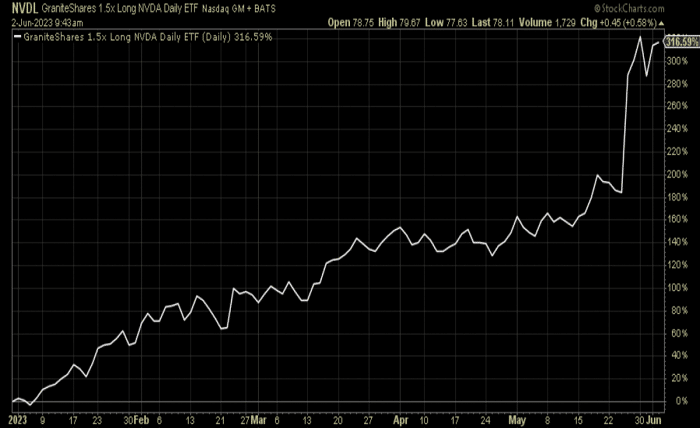

The historical performance of NVDL stock is a testament to NVIDIA’s growth and technological advancements. Over the past decade, NVDL stock has shown remarkable growth, driven by the increasing demand for GPUs in gaming, data centers, and AI applications. Investors who have held NVDL stock long-term have witnessed substantial returns, reflecting the company’s strong market position and continuous innovation.

Market Potential of NVDL Stock

The market potential of NVDL stock is vast, primarily due to NVIDIA’s leadership in the GPU market and its expansion into AI and machine learning sectors. The company’s technology is critical in various industries, including autonomous vehicles, healthcare, and cloud computing. This diversification enhances the growth prospects of NVDL stock, making it an attractive option for investors seeking exposure to multiple high-growth areas.

Factors Influencing NVDL Stock Price

Several factors influence the price of NVDL stock. Key determinants include technological advancements, market demand for GPUs, financial performance, and macroeconomic conditions. Additionally, strategic partnerships and acquisitions play a significant role in shaping investor sentiment and driving the value of NVDL stock. Staying informed about these factors can help investors anticipate market movements and make better investment decisions.

Financial Health of NVIDIA Corporation

Understanding the financial health of NVIDIA Corporation is crucial for evaluating NVDL stock. The company’s robust financial performance, characterized by strong revenue growth, healthy profit margins, and substantial cash reserves, provides a solid foundation for NVDL stock. Regularly reviewing NVIDIA’s financial statements, including income statements, balance sheets, and cash flow statements, can offer valuable insights into the stock’s stability and growth potential.

Competitive Landscape and NVDL Stock

The competitive landscape significantly impacts NVDL stock. NVIDIA faces competition from other tech giants like AMD and Intel, which also develop GPUs and AI technologies. Despite this competition, NVIDIA’s focus on innovation and its leading market share in key segments provide a competitive edge. Analyzing the competitive dynamics and NVIDIA’s strategies can help investors gauge the future performance of NVDL stock.

Risks Associated with NVDL Stock

Investing in NVDL stock carries certain risks that investors need to consider. Market volatility, technological changes, and regulatory challenges are some of the risks that can impact the stock’s performance. Additionally, geopolitical tensions and supply chain disruptions can affect NVIDIA’s operations and, consequently, the value of NVDL stock. Being aware of these risks allows investors to make more balanced and informed decisions.

NVDL Stock and Technological Innovations

Technological innovations are at the heart of NVDL stock’s appeal. NVIDIA’s continuous advancements in GPU technology, AI, and machine learning drive its growth and market position. The company’s products, such as the GeForce GPUs and NVIDIA DRIVE platform, exemplify its commitment to innovation. These technological breakthroughs not only enhance NVIDIA’s market presence but also bolster the investment potential of NVDL stock.

How to Invest in NVDL Stock

Investing in NVDL stock involves several steps. First, investors should conduct thorough research to understand the company’s business model, market position, and financial health. Opening a brokerage account and choosing the right investment strategy, whether long-term holding or short-term trading, is essential. Monitoring market trends and staying updated with NVIDIA’s corporate developments can also aid in making informed investment decisions.

Future Outlook for NVDL Stock

The future outlook for NVDL stock appears promising, driven by NVIDIA’s strategic initiatives and growth in key sectors. The increasing adoption of AI, expansion into new markets, and continuous innovation are likely to sustain the stock’s upward trajectory. However, investors should remain vigilant of market conditions and potential risks to optimize their investment in NVDL stock.

Conclusion

NVDL stock represents a compelling investment opportunity, backed by NVIDIA’s strong market position and technological prowess. Understanding the various factors influencing NVDL stock, including its historical performance, market potential, and associated risks, can help investors make more informed decisions. By staying informed and adopting a strategic approach, investors can potentially reap significant benefits from their investment in NVDL stock.

FAQs

1. What is NVDL stock?

NVDL stock represents shares of NVIDIA Corporation, a leading company in graphics processing units (GPUs) and artificial intelligence (AI) technology.

2. Why is NVDL stock considered a good investment?

NVDL stock is considered a good investment due to NVIDIA’s strong market position, continuous innovation, and significant growth potential in various high-demand sectors.

3. What factors influence the price of NVDL stock?

The price of NVDL stock is influenced by technological advancements, market demand for GPUs, financial performance, macroeconomic conditions, and strategic partnerships.

4. What are the risks associated with investing in NVDL stock?

Risks associated with NVDL stock include market volatility, technological changes, regulatory challenges, geopolitical tensions, and supply chain disruptions.

5. How can I start investing in NVDL stock?

To start investing in NVDL stock, conduct thorough research on NVIDIA Corporation, open a brokerage account, choose an investment strategy, and stay updated with market trends and company developments.